Real Estate Investment Philosophy & Strategy

At Clear Path, our investment strategy targets privately held commercial real estate in high-growth markets in the Southeast, with a primary focus in the Carolinas. The resilience of durable assets coupled with the potential of strong markets form an ideal backdrop to generate compelling investment returns.

But success in commercial real estate demands more – we understand the intricacies of value creation and how to precisely execute investment plans. Our experienced team is dedicated to realizing successful outcomes at every turn.

Our Real Estate Investment Process

We Keep It Local

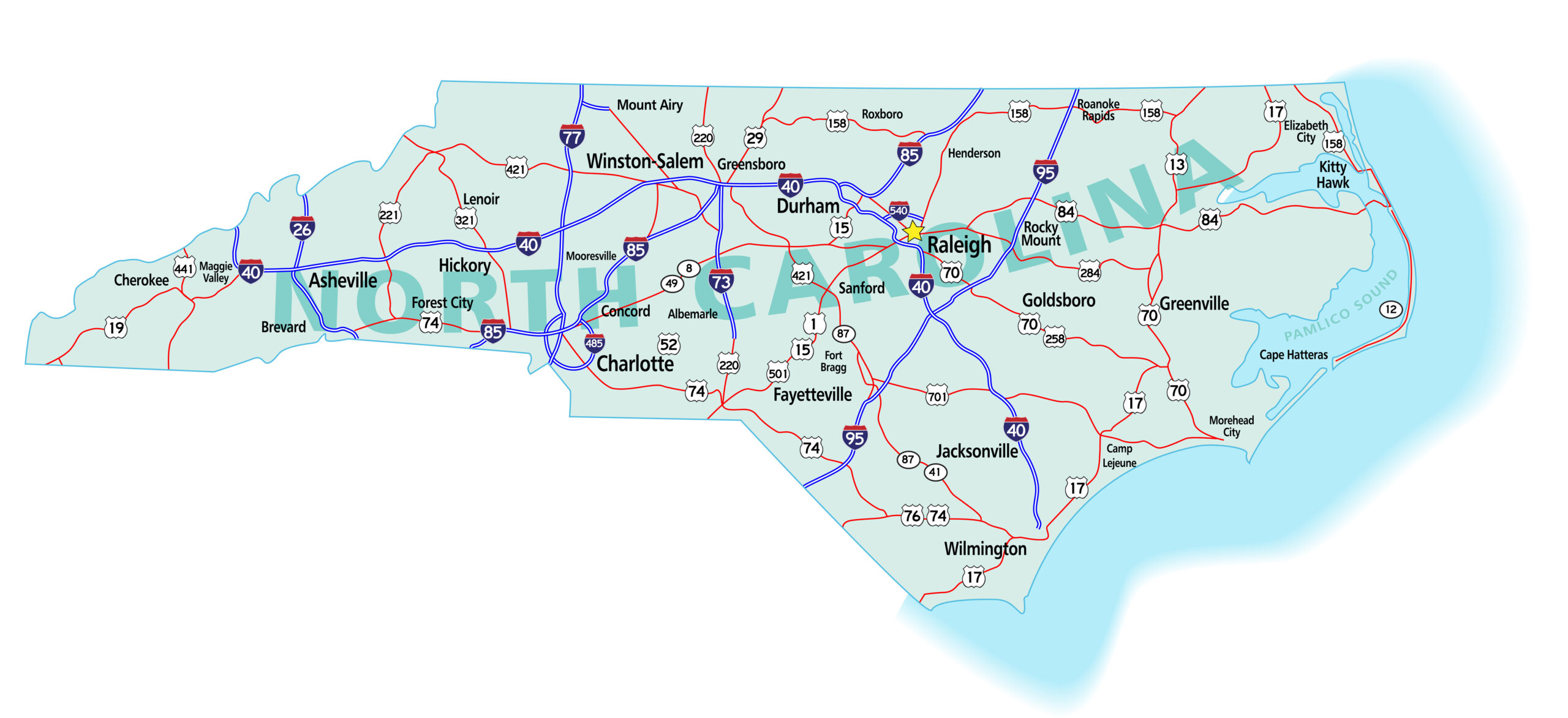

We primarily invest in our own extended backyard. From our home base in Durham, North Carolina, some of the nation’s strongest markets are within a short drive. North Carolina has the unique distinction as a top ten state in both population and population growth. We love big markets like Raleigh and Charlotte, and also smaller nearby markets like Greenville, South Carolina.

We Benefit from our Relationships

We Examine Deeply

We Dive In

We Optimize the Asset

We Deliver Results